In a Nutshell

The Green

Ammonia consists of two elements, nitrogen and hydrogen, in the ratio of 1:3 (NH3). The way these two elements are produced have a significant impact on the emissions when producing ammonia.

Today, the standard method of ammonia production uses fossil fuels. Coal or natural gas is the raw material as well as the energy source to this process. This standard process releases more than twice as much carbon dioxide emissions as it does ammonia.

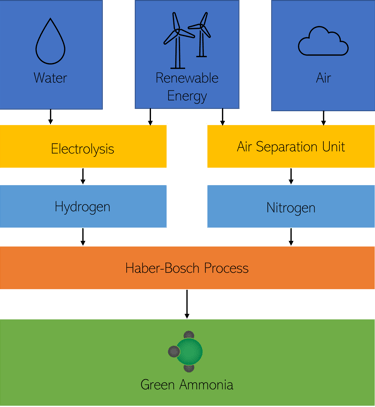

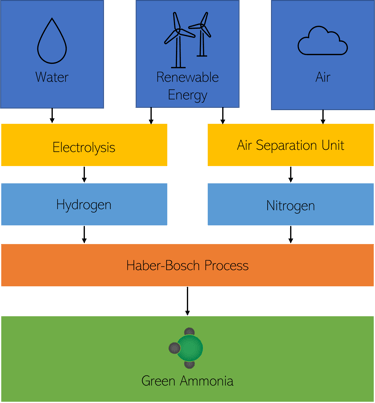

Green Ammonia simply requires water and air as raw materials and renewable energy to maintain the process. It is synthesised using the same process as fossil-based, called the Haber-Bosch process. This is achieved through a couple of processes; electrolysis and cryogenic air distillation. These processes only utilise electricity - in this case from renewable sources. This process has zero emissions, thus delivering completely Green Ammonia.

Method

Electrolysis splits pure water into hydrogen and oxygen gas. This process is energy intensive and accounts for a large part of the operating costs related to Green Ammonia production. Electrolysers have become cheaper as production volumes has increased. Electrolysers are limited in production capacity of relatively small scale, which makes them modular in cost.

Cryogenic air distillation cools air and separates oxygen and nitrogen. This is achieved by utilising the different boiling temperatures, thereby liquifying oxygen and nitrogen into pure fractions.

In addition to water and air, renewable electricity is required to operate the processes. Northern Sweden has high production capacity and cheap electricity, which can facilitate a grid-connected plant. To ensure green electricity, certificates are purchased to secure the origin of the electricity.

The shift to Green Ammonia will reduce emissions as fossil fuels are excluded from the production process. Furthermore, Green Ammonia is not geographically tied to locations with access to coal or natural gas, thereby reducing the need for long transports.

Past, Present, Predictions

PAST

The market has constituted approximately 180 million tonnes annually, of which, 70-80% has been used for the production of fertilisers. Ammonia has seen a steady historic market growth, which has been somewhat proportionate to the growth in global population. Ammonia, through its purpose as fertiliser, has sustained food production to support the global population growth.

The market has been saturated with fossil-based ammonia, produced in locations with cheap and available coal or natural gas. Some countries are rich in natural resources whereas others are not, which has entailed ammonia as a commonly exported commodity. There are well-established protocols and technologies for producing, storing and transporting ammonia globally.

Cost of fossil fuels and emissions has been at low rates, generating low production costs and taxes to fossil-based ammonia. Historic prices of ammonia has been in the region of 300 USD/tonne.

There has been no distinction in prices between Green Ammonia and fossil-based in the past, as there has been only one small-scale Green Ammonia plant globally. The limited Green Ammonia production has been due to it not being as cost efficient in comparison to fossil-based.

PRESENT

Currently, the ammonia market in undergoing a paradigm shift, particularly Green Ammonia. Besides its purpose as fertiliser, Green Ammonia is gaining attention as a renewable energy carrier and fuel.

In a hydrogen economy, Green Ammonia can serve and function as a hydrogen carrier, hydrogen storage and hydrogen fuel. This is possible due to its physical properties. Ammonia is liquid at lower pressures and higher temperature than pure hydrogen, while still functioning as a zero carbon fuel. Ammonia has a higher volumetric energy density but does, however, have a lower energy density in terms of mass than pure hydrogen.

The Green Ammonia market is starting to differentiate from fossil-based market, as production emissions would defeat its purpose in a hydrogen economy. Existing plants are starting to use mixtures of fossil-based and renewable hydrogen, while still relying on fossil energy and nitrogen. With the current limited Green Ammonia production, the market is still shared with fossil-based ammonia.

Ammonia plants have an expected lifespan of 20-50 years. In Europe, the current average age of ammonia plants is 40 years. Additionally, Europe is producing approximately 16 million tonnes annually, while consuming 20 million tonnes. Furthermore, the EU has implemented a Carbon Border Adjustment Mechanism (CBAM) taxing emissions on imports on products, including products related to energy and fertilisers. At the same time, the price of emissions in the EU have seen an increase over the last years.

The rising prices of coal and natural gas have, in turn, affected the price of ammonia. Although ammonia has increased too, several ammonia plants have reduced production or shut down due to production costs. The price of ammonia has been over 1,000 USD/tonne. These current ammonia prices have made Green Ammonia competitive in the same market as fossil-based. Thereby jump-starting the possibility to manufacture Green Ammonia and establish a key position as the market differentiates from fossil-based further.

The maritime sector is pursuing Green Ammonia as a fuel for ocean-going vessels as a mean to reach the 2030 emission goals set by the International Maritime Organization. The maritime sector consumes 330 million tonnes of fuel annually. Green Ammonia contains approximately half of the energy content as fossil fuels, meaning that a shift from fossil fuels to Green Ammonia would require more than twice the amount.

PREDICTIONS

The coal and natural gas prices which have swiftly increased the price of ammonia, could be the argument for a short-term price elevation. However, it is more likely an accurate representation of the market long-term, due to the following macroeconomic aspects.

By 2030 most of Europe's ammonia plants have reached the end of their lifespan, while only a capacity of 8 million tonnes annually of Green Ammonia has been planned by 2030. A significant deficit in supply compared to the EU's demand.

The EU's CBAM will be implemented by 2026, which will prevent cheap and emission intense imports of fossil-based ammonia to the EU. In combination with CBAM, the price of emissions is forecasted to increase further, thereby limiting the recession of the fossil-based ammonia price.

Even if the switch of fuel in the maritime sector was limited to 5%, the market impact this has to the current ammonia market is an increase of close to 20%. Furthermore, this market share would be earmarked for Green Ammonia, rather than fossil-based.

Green Ammonia will be able to compete in the market with fossil-based, while also gaining a separate market for itself. This differentiation of Green Ammonia and fossil-based will generate a premium for the Green Ammonia.

To conclude, even though it is currently high prices for fossil-based ammonia, this analysis assesses that Green Ammonia will fetch even higher prices as it differentiates from fossil-based ammonia, earns a green premium and as the market continues to grow.

The Lean

NH3 GREENTECH AB has identified key synergies for Green Ammonia production, to generate additional revenue and keep production costs low.

Green Ammonia production generates oxygen gas as a by-product, both through the electrolysis of water and cryogenic distillation of air. Normally this gas is released to the atmosphere and assigned no value due to costly transportation and low prices of oxygen.

This oxygen could serve a purpose in synthesis of fertiliser derivates such as in the production of nitric acid. However, for the use of Green Ammonia as energy carrier this would not be possible. NH3 GREENTECH AB will therefore sell it to another oxygen consuming industry, to create a more circular process while generating value from this by-product through a synergetic relationship.

NH3 GREENTECH AB will locate its production in the vicinity of large oxygen consuming industries to reduce transportation of oxygen. There are several industries in Sweden which requires and could benefit further from large quantities of oxygen gas, e.g. pulp mills.

NH3 GREENTECH AB will gain additional synergy from the Green Ammonia plant in the role as frequency regulator on the electricity grid. The electrolysers can be used to regulate frequency and peak shave prices on the electricity grid. Thereby generating additional environmental value while reducing cost of hydrogen.

Regulating the grid with the electrolysers does, however, cause an irregular production of hydrogen. To overcome this, hydrogen storage is implemented. Additionally, battery storage will also be implemented, to serve the purpose of peak shaving prices and maintaining a constant hydrogen output. Thereby reducing the average price of electricity, resulting in cheaper Green Ammonia while keeping the production constant.